- Full-year FFO per Share in Line with Previous Guidance - -

Property Market Fundamentals Showing Signs of Improvement - -

Company Establishes 2010 Guidance - DENVER, Feb. 11

/PRNewswire-FirstCall/ -- ProLogis (NYSE:PLD), a leading global

provider of distribution facilities, today reported funds from

operations as defined by ProLogis (FFO), excluding significant

non-cash items, of $1.15 per diluted share in 2009, compared with

$3.51 for 2008. (See Summary of Results table for details). These

amounts reflect the add back of impairments on real estate

properties, goodwill and other assets totaling $0.81 per diluted

share in 2009 and $3.01 in 2008. ProLogis reported a net loss per

diluted share of $0.01 for 2009, compared with a net loss of $1.82

for 2008. For the fourth quarter, FFO, excluding significant

non-cash items, was $0.13 per diluted share in 2009, compared with

$0.56 in 2008. These amounts reflect the add back of impairments on

real estate properties, goodwill and other assets totaling $0.78

per diluted share in the fourth quarter of 2009 and $3.04 in 2008.

For the fourth quarter of 2009, the company reported a net loss per

diluted share of $0.86, compared with a net loss of $3.39 in the

same period of 2008. Reconciliation to Previous Guidance In

addition to the non-cash impairment charges referred to above, the

company experienced various non-recurring charges in the fourth

quarter and earlier in 2009, as detailed below. FFO, excluding

significant non-cash items and non-recurring charges, was $1.41 per

diluted share for the full year, in line with the company's

previous guidance of $1.39 to $1.43. For the fourth quarter, FFO,

excluding significant non-cash items and non-recurring charges, was

$0.23 per diluted share. Three Months Twelve Months Ended Ended

December 31, December 31, 2009 2009 ---- ---- FFO, excluding

significant non-cash items $0.13 $1.15 Add (deduct) non-recurring

charges: Indemnifications related to contributed or sold properties

0.08 0.09 Realized losses on foreign currency transactions - 0.05

Capital markets costs 0.03 0.04 ProLogis' share of losses on sale

of fund assets - 0.03 Reduction in workforce - 0.03 Other 0.01 0.04

Adjustments to tax and compensation-related liabilities (0.02)

(0.02) ---- ---- Add summarized non-recurring charges 0.10 0.26

---- ---- FFO, excluding significant non-cash items and

non-recurring charges $0.23 $1.41 Significant Accomplishments in

2009 Position Company for Future Opportunities "We began 2009 with

an action plan and aggressive goals related to asset dispositions,

debt reduction and development portfolio leasing," said Walter C.

Rakowich, chief executive officer. "Throughout the year, we made

tough choices and remained highly focused on stabilizing the

company. We are pleased to have accomplished our goals, putting the

company on firm financial footing and positioning us to take

advantage of opportunities as market conditions improve." Among

ProLogis' specific goals for 2009 were to: reduce debt by $2

billion, complete $1.5 to $1.7 billion of asset dispositions and

contributions to property funds (exclusive of the sale of certain

Asian operations) and achieve static development portfolio leasing

of 60 to 70 percent. At year end 2009, the company had reduced debt

by $2.7 billion, completed $1.53 billion of property dispositions

and contributions and achieved static development portfolio leasing

of 68.2 percent. Continued Signs of Stabilization and Improvement

in Property Markets "While focusing on our action plan, we also

worked diligently to maintain stable occupancies in our core

portfolio," Rakowich added. "The bottoming of market occupancies

and rents that we began to see in mid-2009 held up in the fourth

quarter, with some markets showing improvement. For the top 31

North American markets we track, overall net demand turned positive

in the fourth quarter, and we saw similar pockets of positive

take-up in Europe. And, although we expect net effective rental

rates on turnovers to be negative throughout 2010, we believe

improving occupancies and the continued lack of new supply will

pave the way for improving rental rates in 2011." ProLogis'

non-development portfolio was 92.4 percent leased at the end of the

fourth quarter, down slightly compared with 92.7 percent leased at

September 30. Same-store net operating income (SS NOI), as adjusted

(excluding same-store assets associated with the company's

development portfolio), decreased 4.2 percent, a slight improvement

over the third quarter SS NOI decline. Net effective rental rates

on turnover of 23.6 million square feet, or 6.0 percent of the

adjusted same-store pool, were down 11.7 percent for the quarter,

representing an improvement over the third quarter decline.

Build-to-Suit Development Demand Supports Reductions in Land

Position "While new speculative development has remained virtually

non-existent, during the fourth quarter we continued to see demand

for build-to-suit development from customers whose supply chain

optimization requirements could not be met with the available

supply of space," said Ted R. Antenucci, chief investment officer.

ProLogis' fourth quarter starts consisted of a 667,000-square-foot

facility for a major home improvement retailer in Southern

California and a 504,000-square-foot facility for a leading UK

retailer in Scotland. Including joint venture partner capital

contributions, total expected investment for all build-to-suit

developments started in the second half of 2009 is $336 million.

"Given the continued interest from customers in build-to-suits, we

expect to start $700 to $800 million of new development in 2010,

primarily in Europe and Asia. We also will continue to pursue land

sales, which when combined with new development, will allow us to

begin to monetize roughly $350 to $400 million of land in 2010,"

Antenucci added. Strategic Repositioning of Asset Base "In 2009, we

used the proceeds from nearly $2.9 billion of contributions and

dispositions, including the sale of certain Asian operations, to

reduce debt and fund our development portfolio," said Rakowich.

"Having stabilized our balance sheet, we are now looking to fund

new development activity in a slightly different, leverage-neutral

manner. Due to improving property values and growing institutional

demand for quality properties, in 2010 we plan to generate $1.3 to

$1.5 billion of proceeds from sales of existing assets and

contributions to funds, primarily in the United States, and use the

proceeds to fund the remaining costs associated with our existing

development portfolio as well as 2010 development starts. This

approach will allow us to retain more of our non-US development on

our balance sheet, thereby improving the geographic diversification

of our direct owned assets." Continued Financing Progress for

ProLogis and Property Funds "We continued to focus on further

extending and smoothing the debt maturities both on ProLogis'

balance sheet and in our property funds," said William E. Sullivan,

chief financial officer. "In the fourth quarter, we issued $600

million of 10-year, ProLogis senior notes and closed on a $108

million secured financing in Japan on our balance sheet. Since the

beginning of the fourth quarter, we closed on euro 886 million of

financings in our European funds, effectively reducing 2010

maturities within those funds to approximately euro 327 million.

This is significant progress from the over euro 1.8 billion of 2010

fund debt maturities we were faced with at the beginning of 2009."

Guidance for 2010 ProLogis established full-year 2010 FFO guidance,

excluding significant non-cash items, of $0.74 to $0.78 per share,

of which approximately $0.10 relates to expected gains on

dispositions of development and land. Net earnings are expected to

be between $0.25 and $0.29 per diluted share. A summary of the

business drivers supporting ProLogis' 2010 guidance is available at

http://ir.prologis.com/2010BusinessDrivers.cfm. Copies of ProLogis'

fourth quarter 2009 supplemental information will be available from

the company's website at http://ir.prologis.com/ in the "Annual

& Supplemental Reports" section before open of market on

Thursday, February 11, 2010. The company will host a

webcast/conference call on Thursday, February 11, 2010, at 10:00

a.m. Eastern Time. The live webcast and the replay will be

available on the company's website at http://ir.prologis.com/.

Additionally, a podcast of the company's conference call will be

available on the company's website. About ProLogis ProLogis is a

leading global provider of distribution facilities, with more than

475 million square feet of industrial space owned and managed (44

million square meters) in markets across North America, Europe and

Asia. The company leases its industrial facilities to more than

4,400 customers, including manufacturers, retailers, transportation

companies, third-party logistics providers and other enterprises

with large-scale distribution needs. For additional information

about the company, go to http://www.prologis.com/. Follow ProLogis

on Twitter: http://twitter.com/ProLogis The statements above that

are not historical facts are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements are based on current expectations,

estimates and projections about the industry and markets in which

ProLogis operates, management's beliefs and assumptions made by

management, they involve uncertainties that could significantly

impact ProLogis' financial results. Words such as "expects,"

"anticipates," "intends," "plans," "believes," "seeks,"

"estimates," variations of such words and similar expressions are

intended to identify such forward-looking statements, which

generally are not historical in nature. All statements that address

operating performance, events or developments that we expect or

anticipate will occur in the future - including statements relating

to rent and occupancy growth, development activity and changes in

sales or contribution volume of developed properties, general

conditions in the geographic areas where we operate and the

availability of capital in existing or new property funds - are

forward-looking statements. These statements are not guarantees of

future performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Although we believe the

expectations reflected in any forward-looking statements are based

on reasonable assumptions, we can give no assurance that our

expectations will be attained and therefore, actual outcomes and

results may differ materially from what is expressed or forecasted

in such forward-looking statements. Some of the factors that may

affect outcomes and results include, but are not limited to: (i)

national, international, regional and local economic climates, (ii)

changes in financial markets, interest rates and foreign currency

exchange rates, (iii) increased or unanticipated competition for

our properties, (iv) risks associated with acquisitions, (v)

maintenance of real estate investment trust ("REIT") status, (vi)

availability of financing and capital, (vii) changes in demand for

developed properties, and (viii) those additional factors discussed

in reports filed with the Securities and Exchange Commission by

ProLogis under the heading "Risk Factors." ProLogis undertakes no

duty to update any forward-looking statements appearing in this

press release. Overview (in thousands, except per share amounts)

Summary of Results Three Months Ended Twelve Months Ended December

31, December 31, --------------------- ---------------------- 2009

2008 (1) 2009 2008 (1) --------- ---------- ---------- ----------

Revenues (9) $ 260,318 $1,468,335 $1,223,082 $5,565,983 Net loss

(a) $(408,459) $ (901,232) $ (2,650) $ (479,226) Net loss per share

- Diluted (a) $ (0.86) $ (3.39) $ (0.01) $(1.82) FFO, including

significant non-cash items (a) $(305,761) $ (660,096) $ 138,885 $

133,840 Add (deduct) significant non-cash items: Impairment of real

estate properties 207,668 274,705 331,592 274,705 Impairment of

goodwill and other assets 157,076 320,636 163,644 320,636

Impairment (net gain) related to disposed assets - China operations

- 198,236 (3,315) 198,236 Loss (gains) on early extinguishment of

debt 960 (90,719) (172,258) (90,719) Our share of the

loss/impairment recorded by PEPR related to PEPF II - 108,195 -

108,195 Our share of similar (gains) losses recognized by the

property funds, net 2,882 - 9,240 - --------- ---------- ----------

---------- Total adjustments for significant non-cash items 368,586

811,053 328,903 811,053 --------- ---------- ---------- ----------

FFO, excluding significant non-cash items (a) $ 62,825 $ 150,957 $

467,788 $ 944,893 ========= ========== ========== ========== FFO

per share - Diluted, including significant non-cash items (a) $

(0.65) $ (2.48) $ 0.34 $ 0.50 Add (deduct) - summarized significant

non-cash adjustments - per share 0.78 3.04 0.81 3.01 ---------

---------- ---------- ---------- FFO per share - Diluted, excluding

significant non-cash items (a) $ 0.13 $ 0.56 $ 1.15 $ 3.51

========= ========== ========== ========== (a) These amounts are

attributable to common shares. Footnotes follow Financial

Statements Consolidated Balance Sheets (in thousands, except per

share data) December 31, December 31, 2009 2008 (1) -----------

------------ Assets: Investments in real estate assets (1):

Industrial properties: Core $ 7,436,539 $ 7,924,507 Completed

development 4,108,962 3,031,449 Properties under development

191,127 1,181,344 Land held for development 2,569,343 2,482,582

Retail and mixed use properties 291,038 358,992 Land subject to

ground leases and other 385,222 425,001 Other investments 233,665

321,397 ----------- ----------- 15,215,896 15,725,272 Less

accumulated depreciation 1,671,100 1,583,299 -----------

----------- Net investments in real estate assets 13,544,796

14,141,973 Investments in and advances to unconsolidated investees:

Property funds (2) 1,876,650 1,957,977 Other unconsolidated

investees 275,073 312,016 ----------- ----------- Total investments

in and advances to unconsolidated investees 2,151,723 2,269,993

Cash and cash equivalents 34,362 174,636 Accounts and notes

receivable 136,754 244,778 Other assets (1) 1,017,780 1,126,993

Discontinued operations - assets held for sale (2) - 1,310,754

----------- ----------- Total assets $16,885,415 $19,269,127

=========== =========== Liabilities and Equity: Liabilities: Debt

(1)(2)(3)(4)(5) $ 7,977,778 $10,711,368 Accounts payable and

accrued expenses 455,919 658,868 Other liabilities 444,432 751,238

Discontinued operations - assets held for sale (2) - 389,884

----------- ----------- Total liabilities 8,878,129 12,511,358

----------- ----------- Equity (6): ProLogis shareholders' equity:

Series C preferred shares at stated liquidation preference of $50

per share 100,000 100,000 Series F preferred shares at stated

liquidation preference of $25 per share 125,000 125,000 Series G

preferred shares at stated liquidation preference of $25 per share

125,000 125,000 Common shares at $.01 par value per share 4,742

2,670 Additional paid-in capital (1) 8,524,867 7,070,108

Accumulated other comprehensive income (loss) 42,298 (29,374)

Distributions in excess of net earnings (1) (934,583) (655,513)

----------- ----------- Total ProLogis shareholders' equity

7,987,324 6,737,891 Noncontrolling interests (7) 19,962 19,878

----------- ----------- Total equity 8,007,286 6,757,769

----------- ----------- Total liabilities and equity $16,885,415

$19,269,127 =========== =========== Footnotes follow Financial

Statements Consolidated Statements of Operations (in thousands,

except per share amounts) Three Months Ended Twelve Months Ended

December 31, December 31, -------------------- --------------------

2009 2008 (1) 2009 2008 (1) --------- --------- --------- ---------

Revenues: Rental income (8) $ 227,362 $ 215,196 $ 891,095 $ 913,650

Property management and other fees and incentives (2) 31,563 33,815

142,763 131,011 CDFS disposition proceeds (9): Developed and

repositioned properties (2) - 1,192,935 180,237 4,206,446 Acquired

property portfolios - 18,781 - 289,019 Development management and

other income 1,393 7,608 8,987 25,857 --------- --------- ---------

--------- Total revenues 260,318 1,468,335 1,223,082 5,565,983

--------- --------- --------- --------- Expenses: Rental expenses

(10) 65,595 60,324 269,956 277,320 Investment management expenses

(10) 11,835 12,344 43,416 50,761 Cost of CDFS dispositions (1)(9):

Developed and repositioned properties - 1,086,150 - 3,551,700

Acquired property portfolios - 18,781 - 289,019 General and

administrative (4)(10)(11) 52,161 36,987 180,486 177,350 Reduction

in workforce (11) - 23,131 11,745 23,131 Impairment of real estate

properties (12) 207,668 274,705 331,592 274,705 Depreciation and

amortization 84,153 97,435 315,807 317,315 Other expenses 4,617

17,446 24,025 28,104 --------- --------- --------- --------- Total

expenses 426,029 1,627,303 1,177,027 4,989,405 --------- ---------

--------- --------- Operating income (loss) (165,711) (158,968)

46,055 576,578 Other income (expense): Earnings (loss) from

unconsolidated property funds, net (13) (6,227) (105,024) 24,908

(69,116) Earnings from other unconsolidated investees, net 301 914

3,151 13,342 Interest expense (1)(14) (107,486) (100,314) (373,305)

(385,065) Impairment of goodwill and other assets (12) (157,076)

(320,636) (163,644) (320,636) Other income (expense), net (33,503)

2,526 (39,349) 16,522 Net gains on dispositions of real estate

properties (9) 12,843 5,853 35,262 11,668 Foreign currency exchange

gains (losses), net (15) 728 (115,303) 35,626 (148,281) Gains

(loss) on early extinguishment of debt (3) (960) 90,719 172,258

90,719 --------- --------- --------- --------- Total other income

(expense) (291,380) (541,265) (305,093) (790,847) ---------

--------- --------- --------- Loss before income taxes (457,091)

(700,233) (259,038) (214,269) Current income tax expense (benefit)

(2) (878) 15,726 29,262 63,441 Deferred income tax expense

(benefit) (2,600) (14,834) (23,287) 4,570 --------- ---------

--------- --------- Total income taxes (3,478) 892 5,975 68,011

--------- --------- --------- --------- Loss from continuing

operations (453,613) (701,125) (265,013) (282,280) Discontinued

operations (16): Income (loss) attributable to disposed properties

1,490 (4,455) 24,163 11,049 Net gain (impairment) related to

disposed assets - China operations (2) - (198,236) 3,315 (198,236)

Net gains on dispositions: Non-development properties 21,024 1,557

220,815 9,718 Development properties and land subject to ground

leases (2) 29,146 7,551 40,649 9,783 --------- --------- ---------

--------- Total discontinued operations 51,660 (193,583) 288,942

(167,686) --------- --------- --------- --------- Consolidated net

earnings (loss) (401,953) (894,708) 23,929 (449,966) Net earnings

attributable to noncontrolling interests (7) (190) (172) (1,156)

(3,837) --------- --------- --------- --------- Net earnings (loss)

attributable to controlling interests (1) (402,143) (894,880)

22,773 (453,803) Less preferred share dividends 6,316 6,352 25,423

25,423 --------- --------- --------- --------- Net loss

attributable to common shares $(408,459) $(901,232) $ (2,650)

$(479,226) ========= ========= ========= ========= Weighted average

common shares outstanding -Basic (6) 473,561 265,898 403,149

262,729 Weighted average common shares outstanding - Diluted (6)

473,561 265,898 403,149 262,729 Net earnings (loss) per share

attributable to common shares - Basic: Continuing operations $

(0.97) $ (2.66) $ (0.73) $ (1.18) Discontinued operations 0.11

(0.73) 0.72 (0.64) --------- --------- --------- --------- Net

earnings (loss) per share attributable to common shares - Basic $

(0.86) $ (3.39) $ (0.01) $ (1.82) ========= ========= =========

========= Net earnings (loss) per share attributable to common

shares -Diluted: Continuing operations $ (0.97) $ (2.66) $ (0.73) $

(1.18) Discontinued operations 0.11 (0.73) 0.72 (0.64) ---------

--------- --------- --------- Net earnings (loss) per share

attributable to common shares -Diluted $ (0.86) $ (3.39) $ (0.01) $

(1.82) ========= ========= ========= ========= Footnotes follow

Financial Statements Consolidated Statements of Funds From

Operations (FFO) (in thousands, except per share amounts) Three

Months Ended Twelve Months Ended December 31, December 31,

--------------------- --------------------- 2009 2008 (1) 2009 2008

(1) --------- --------- --------- ---------- Revenues: Rental

income $ 229,906 $ 249,778 $ 941,587 $1,035,335 Property management

and other fees and incentives (2) 31,563 34,466 142,856 132,038

CDFS disposition proceeds (9): Developed and repositioned

properties (2) - 1,239,378 180,237 4,271,786 Acquired property

portfolios - 18,781 - 372,667 Development management and other

income 1,393 7,822 8,987 26,344 --------- --------- ---------

---------- Total revenues 262,862 1,550,225 1,273,667 5,838,170

--------- --------- --------- ---------- Expenses: Rental expenses

(10) 66,162 73,746 284,390 319,378 Investment management expenses

(10) 11,835 12,344 43,416 50,761 Cost of CDFS dispositions (1)(9):

Developed and repositioned properties - 1,126,198 - 3,610,123

Acquired property portfolios - 18,781 - 372,667 General and

administrative (10)(11) 52,161 45,896 181,791 199,074 Reduction in

workforce (11) - 26,431 11,745 26,431 Impairment of real estate

properties (12) 207,668 274,705 331,592 274,705 Depreciation of

corporate assets 3,828 4,177 15,897 16,332 Other expenses 4,617

21,400 24,031 33,192 --------- --------- --------- ---------- Total

expenses 346,271 1,603,678 892,862 4,902,663 --------- ---------

--------- ---------- Operating FFO (83,409) (53,453) 380,805

935,507 Other income (expense): FFO from unconsolidated property

funds (13) 41,679 (62,039) 157,197 66,415 FFO from other

unconsolidated investees 1,952 858 10,878 6,162 Interest expense

(1) (107,486) (100,398) (373,135) (384,526) Net gain (impairment)

related to assets held for sale - China operations (2) - (198,236)

3,315 (198,236) Impairment of goodwill and other assets (12)

(157,076) (320,636) (163,644) (320,636) Other income (expense), net

(33,503) 3,724 (39,277) 20,806 Net gains on dispositions of real

estate properties (9) 35,515 - 65,587 - Foreign currency exchange

gains (losses), net (503) 723 (22,571) (7,009) Gains (loss) on

early extinguishment of debt (3) (960) 90,719 172,258 90,719

Current income tax benefit (expense) (2)(17) 4,536 (16,727)

(25,805) (56,170) --------- --------- --------- ---------- Total

other income (expense) (215,846) (602,012) (215,197) (782,475)

--------- --------- --------- ---------- FFO (299,255) (655,465)

165,608 153,032 Less preferred share dividends 6,316 6,352 25,423

25,423 Less net earnings (loss) attributable to noncontrolling

interests (7) 190 (1,721) 1,300 (6,231) --------- ---------

--------- ---------- FFO attributable to common shares, including

significant non-cash items $(305,761) $(660,096) $ 138,885 $

133,840 Adjustments for significant non-cash items 368,586 811,053

328,903 811,053 --------- --------- --------- ---------- FFO

attributable to common shares, excluding significant non-cash items

$ 62,825 $ 150,957 $ 467,788 $ 944,893 ========= =========

========= ========== Weighted average common shares outstanding -

Basic (6) 473,561 265,898 403,149 262,729 FFO per share

attributable to common shares, including significant non-cash

items: Basic $ (0.65) $ (2.48) $ 0.34 $ 0.51 ========= =========

========= ========== Diluted $ (0.65) $ (2.48) $ 0.34 $ 0.50

========= ========= ========= ========== FFO per share attributable

to common shares, excluding significant non-cash items: Basic $

0.13 $ 0.57 $ 1.16 $ 3.60 ========= ========= ========= ==========

Diluted $ 0.13 $ 0.56 $ 1.15 $ 3.51 ========= ========= =========

========== Footnotes follow Financial Statements Reconciliations of

Net Loss to FFO and EBITDA (in thousands) Reconciliation of net

loss to FFO, including significant non-cash items Three Months

Ended Twelve Months Ended December 31, December 31,

--------------------- -------------------- 2009 2008 (1) 2009 2008

(1) --------- --------- -------- --------- Net loss (a) $(408,459)

$(901,232) $ (2,650) $(479,226) Add (deduct) NAREIT defined

adjustments: Real estate related depreciation and amortization

80,325 93,258 299,910 300,983 Adjustments to gains on dispositions

for depreciation (3,183) (1,156) (5,387) (2,866) Gains on

dispositions of non-development/ non-CDFS properties (3,291)

(5,806) (4,937) (11,620) Reconciling items attributable to

discontinued operations (16): Gains on dispositions of

non-development/ non-CDFS properties (21,024) (1,557) (220,815)

(9,718) Real estate related depreciation and amortization 487 9,012

11,319 33,661 --------- --------- -------- --------- Total

discontinued operations (20,537) 7,455 (209,496) 23,943 Our share

of reconciling items from unconsolidated investees: Real estate

related depreciation and amortization 40,361 51,159 154,315 155,067

Adjustment to gains/losses on dispositions for depreciation (1,681)

(329) (9,569) (492) Other amortization items (3,954) (3,337)

(11,775) (15,840) --------- --------- -------- --------- Total

unconsolidated investees 34,726 47,493 132,971 138,735 ---------

--------- -------- --------- Total NAREIT defined adjustments

88,040 141,244 213,061 449,175 --------- --------- --------

--------- Subtotal- NAREIT defined FFO (320,419) (759,988) 210,411

(30,051) Add (deduct) our defined adjustments: Foreign currency

exchange losses (gains), net (15) (1,231) 117,145 (58,128) 144,364

Current income tax expense (17) 3,658 - 3,658 9,656 Deferred income

tax expense (benefit) (2,600) (15,406) (23,299) 4,073 Our share of

reconciling items from unconsolidated investees: Foreign currency

exchange losses (gains), net (15) (947) (82) (1,737) 2,331

Unrealized losses (gains) on derivative contracts, net (1,394)

18,007 (7,561) 23,005 Deferred income tax expense (benefit) 17,172

(19,772) 15,541 (19,538) --------- --------- -------- ---------

Total unconsolidated investees 14,831 (1,847) 6,243 5,798 ---------

--------- -------- --------- Total our defined adjustments 14,658

99,892 (71,526) 163,891 --------- --------- -------- --------- FFO,

including significant non-cash items (a) $(305,761) $(660,096)

$138,885 $ 133,840 ========= ========= ======== =========

Reconciliation of FFO, including significant non-cash items, to

FFO, excluding significant non-cash items Three Months Ended Twelve

Months Ended December 31, December 31, ---------------------

-------------------- 2009 2008 (1) 2009 2008 (1) ---------

--------- -------- -------- FFO, including significant non-cash

items (a) $(305,761) $(660,096) $138,885 $133,840 Add (deduct)

significant non-cash items: Impairment of real estate properties

(12) 207,668 274,705 331,592 274,705 Impairment of goodwill and

other assets (12) 157,076 320,636 163,644 320,636 Impairment (net

gain) related to disposed assets - China operations (2) - 198,236

(3,315) 198,236 Loss (gains) on early extinguishment of debt (3)

960 (90,719) (172,258) (90,719) Our share of the loss/ impairment

recorded by PEPR - 108,195 - 108,195 Our share of certain (gains)

losses recognized by the property funds 2,882 - 9,240 - ---------

--------- -------- -------- Total adjustments for significant

non-cash items 368,586 811,053 328,903 811,053 --------- ---------

-------- -------- FFO, excluding significant non-cash items (a) $

62,825 $ 150,957 $467,788 $944,893 ========= ========= ========

======== Reconciliation of FFO, excluding significant non-cash

items, to EBITDA Three Months Ended Twelve Months Ended December

31, December 31, -------------------- ---------------------- 2009

2008 (1) 2009 2008 (1) -------- -------- ---------- ---------- FFO,

excluding significant non-cash items (a) $ 62,825 $150,957 $

467,788 $ 944,893 Interest expense 107,486 100,398 373,135 384,526

Depreciation of corporate assets 3,828 4,177 15,897 16,332 Current

income tax expense (benefit) included in FFO (4,536) 16,727 25,805

56,170 Adjustments to gains on dispositions for interest

capitalized 5,251 12,637 16,795 57,632 Preferred share dividends

6,316 6,352 25,423 25,423 Share of reconciling items from

unconsolidated investees 41,284 33,812 173,682 173,900 --------

-------- ---------- ---------- Earnings before interest, taxes,

depreciation and amortization (EBITDA) $222,454 $325,060 $1,098,525

$1,658,876 ======== ======== ========== ========== See Consolidated

Statements of Operations and Consolidated Statements of FFO.

Footnotes follow Financial Statements (a) Attributable to common

shares. Calculation of Per Share Amounts (in thousands, except per

share amounts) Net Loss Per Share Three Months Ended Twelve Months

Ended December 31, December 31, ----------------------

--------------------- 2009 (a) 2008 (a) 2009 (a) 2008 (a) ---------

--------- -------- ---------- Net loss - Basic (b) $(408,459)

$(901,232) $ (2,650) $(479,226) Noncontrolling interest

attributable to convertible limited partnership units (c) - - - -

--------- --------- -------- --------- Adjusted loss - Diluted (b)

$(408,459) $(901,232) $ (2,650) $(479,226) ========= =========

======== ========= Weighted average common shares outstanding -

Basic 473,561 265,898 403,149 262,729 Incremental weighted average

effect of conversion of limited partnership units (c) - - - -

Incremental weighted average effect of stock awards (d) - - - -

--------- --------- -------- --------- Weighted average common

shares outstanding - Diluted 473,561 265,898 403,149 262,729 Net

loss per share - Diluted (b) $ (0.86) $ (3.39) $ (0.01) $ (1.82)

========= ========= ======== ========= FFO Per Share, including

significant non-cash items Three Months Ended Twelve Months Ended

December 31, December 31, ----------------------

-------------------- 2009 (a) 2008 (a) 2009 2008 ---------

--------- -------- -------- FFO - Basic, including significant

non-cash items (b) $(305,761) $(660,096) $138,885 $133,840

Noncontrolling interest attributable to convertible limited

partnership units (c) - - - - --------- --------- -------- --------

FFO - Diluted, including significant non-cash items (b) $(305,761)

$(660,096) $138,885 $133,840 ========= ========= ======== ========

Weighted average common shares outstanding - Basic 473,561 265,898

403,149 262,729 Incremental weighted average effect of conversion

of limited partnership units (c) - - - - Incremental weighted

average effect of stock awards (d) - - 2,474 3,372 ---------

--------- -------- -------- Weighted average common shares

outstanding - Diluted 473,561 265,898 405,623 266,101 =========

========= ======== ======== FFO per share - Diluted, including

significant non-cash items (b) $ (0.65) $ (2.48) $ 0.34 $ 0.50

========= ========= ======== ======== FFO Per Share, excluding

significant non-cash items Three Months Ended Twelve Months Ended

December 31, December 31, ----------------------

-------------------- 2009 2008 2009 2008 --------- ---------

-------- -------- FFO - Basic, including significant non-cash items

(b) $(305,761) $(660,096) $138,885 $133,840 Adjustments for

significant non-cash items 368,586 811,053 328,903 811,053

Noncontrolling interest attributable to convertible limited

partnership units (c) - 172 1,156 3,837 --------- ---------

-------- -------- FFO - Diluted, excluding significant non-cash

items (b) $ 62,825 $ 151,129 $468,944 $948,730 ========= =========

======== ======== Weighted average common shares outstanding -

Basic 473,561 265,898 403,149 262,729 Incremental weighted average

effect of conversion of limited partnership units (c) - 2,551 1,100

4,447 Incremental weighted average effect of stock awards (d) 3,159

1,527 2,474 3,372 --------- --------- -------- -------- Weighted

average common shares outstanding - Diluted 476,720 269,976 406,723

270,548 ========= ========= ======== ======== FFO per share -

Diluted, excluding significant non-cash items (b) $ 0.13 $ 0.56 $

1.15 $ 3.51 ========= ========= ======== ======== (a) In periods

with a net loss, the inclusion of any incremental shares is

anti-dilutive, and, therefore, both basic and diluted shares are

the same. (b) Attributable to common shares. (c) If the impact of

the conversion of limited partnership units is anti- dilutive, the

income and shares are not included in the diluted per share

calculation. (d) Total weighted average potentially dilutive awards

outstanding were 10,949 and 10,833 for the three months ended

December 31, 2009 and 2008, respectively, and 11,539 and 10,204 for

the year-ended December 31, 2009 and 2008, respectively. Of the

potentially dilutive instruments, 5,639 and 7,506, were

anti-dilutive for the three months ended December 31, 2009 and

2008, respectively, and 6,781 and 6,647, were anti-dilutive for the

year-ended December 31, 2009 and 2008. In a loss period, the effect

of stock awards is not included as the impact is anti-dilutive.

Notes to Financial Statements Please also refer to our annual and

quarterly financial statements filed with the Securities and

Exchange Commission on Forms 10-K and 10-Q for further information

about us and our business. Certain 2008 amounts included in our

financial statements have been reclassified to conform to the 2009

presentation. (1) In May 2008, the Financial Accounting Standards

Board ("FASB") issued a new standard that requires separate

accounting for the debt and equity components of certain

convertible debt. The value assigned to the debt component is the

estimated fair value of a similar bond without the conversion

feature at the time of issuance, which would result in the debt

being recorded at a discount. The resulting debt discount is

amortized through the first redeemable option date as additional

non-cash interest expense. We adopted this standard on January 1,

2009, as required, on a retroactive basis for the convertible notes

we issued in 2007 and 2008. As a result, we restated our 2008

results to reflect the additional interest expense and the

additional capitalized interest related to our development

activities for both properties we currently own, as well as

properties that were contributed during the applicable periods.

This restatement impacted earnings and FFO. The following tables

illustrate the impact of the restatement on our Consolidated

Balance Sheets and Consolidated Statements of Operations and FFO

for these periods (in thousands): As of December 31, 2008

------------------------------------------ As Reported Adjustments

As Restated ----------- ----------- ----------- Consolidated

Balance Sheet: ------------ Net investments in real estate assets

$15,706,172 $ 19,100 $15,725,272 Other assets $ 1,129,182 $ (2,189)

$ 1,126,993 Debt $11,007,636 $(296,268) $10,711,368 Additional paid

in capital $ 6,688,615 $ 381,493 $ 7,070,108 Distributions in

excess of net earnings $ (587,199) $ (68,314) $ (655,513) For the

Three Months Ended, December 31, 2008

--------------------------------------------- As Reported

Adjustments(a) As Restated ----------- -------------- -----------

(before 2009 discontinued operations adjustment) Consolidated

Statements of Operations: -------------- Cost of CDFS dispositions

$1,102,053 $ 2,878 $1,104,931 Interest expense, net of

capitalization $ 88,737 $ 11,289 $ 100,026 Net loss attributable to

controlling interests $ (880,713) $(14,167) $ (894,880) For the

Twelve Months Ended, December 31, 2008

---------------------------------------------- As Reported

Adjustments (a) As Restated ----------- --------------- -----------

(before 2009 discontinued operations adjustment) Consolidated

Statements of Operations: --------------- Cost of CDFS dispositions

$3,836,519 $ 4,200 $3,840,719 Interest expense, net of

capitalization $ 341,305 $ 42,830 $ 384,135 Net loss attributable

to controlling interests $ (406,773) $(47,030) $ (453,803) (a) The

adjustments are the same in our Consolidated Statements of FFO. (2)

On February 9, 2009, we sold our operations in China and our

property fund interests in Japan to affiliates of GIC Real Estate,

the real estate investment company of the Government of Singapore

Investment Corporation ("GIC RE"), for total cash consideration of

$1.3 billion ($845 million related to China and $500 million

related to the Japan investments). We used the proceeds primarily

to pay down borrowings on our credit facilities. All of the assets

and liabilities associated with our China operations were

classified as Assets and Liabilities Held for Sale in our

accompanying Consolidated Balance Sheet as of December 31, 2008. In

the fourth quarter of 2008, based on the carrying values of these

assets and liabilities, as compared with the estimated sales

proceeds less costs to sell, we recognized an impairment of $198.2

million. In connection with the sale in the first quarter of 2009,

we recognized a $3.3 million gain on sale. In addition, the results

of our China operations are presented as discontinued operations in

our accompanying Consolidated Statements of Operations for all

periods. All operating information presented throughout this report

excludes China operations. In connection with the sale of our

investments in the Japan property funds, we recognized a gain of

$180.2 million. The gain is reflected as CDFS Proceeds in our

Consolidated Statements of Operations and FFO, as it represents

previously deferred gains on the contribution of properties to the

property funds based on our ownership interest in the property

funds at the time of original contribution of properties. We also

recognized $20.5 million in current income tax expense related to

the Japan portion of the transaction. In April 2009, we sold one

property in Japan to GIC RE for $128.1 million, resulting in a gain

on sale of $13.1 million that is reflected as Discontinued

Operations - Net Gains on Dispositions of Development Properties

and Land Subject to Ground Leases and as Net Gains on Dispositions

of Real Estate Properties in our Consolidated Statements of

Operations and FFO, respectively. The building and related

borrowings were classified as held for sale at December 31, 2008.

We continued to manage the Japan properties until July 2009. In

connection with the termination of the management agreement, we

earned a termination fee of $16.3 million that is included in

Property Management and Other Fees and Incentives in our

Consolidated Statements of Operations and FFO. (3) During the three

and twelve months ended December 31, 2009 in connection with our

announced initiatives to reduce debt, we repurchased portions of

several series of notes outstanding, the majority of which were at

a discount, and extinguished some secured mortgage debt prior to

maturity. These transactions resulted in the recognition of net

gains or losses and are summarized, as follows (in thousands): For

the For the For the Three Three Twelve and Twelve Months Ended

Months Ended Months Ended December 31, December 31, December 31,

2009 2009 2008 ------------ ------------ ------------- Convertible

Senior Notes: Original principal amount $117,736 $ 653,993 $ - Cash

purchase price $102,920 $ 454,023 $ - Senior Notes (a): Original

principal amount $224,506 $ 587,698 $309,722 Cash purchase price

$226,754 $ 545,618 $216,805 Secured Mortgage Debt: Original

principal amount (b) $ - $ 227,017 $ - Cash extinguishment price $

- $ 227,017 $ - Total: Original principal amount $342,242

$1,468,708 $309,722 Cash purchase/ extinguishment price $329,674

$1,226,658 $216,805 Gain (loss) on early extinguishment of debt(c)

$ (960) $ 172,258 $ 90,719 (a) Included in the twelve months ended

December 31, 2009 is the repurchase of euro 248.7 million ($356.4

million) original principal amount of our Euro senior notes for

euro 235.1 million ($338.7 million). (b) In addition, there was an

unamortized premium of $11.4 million (recorded at acquisition) that

was included in the calculation of the gain on early

extinguishment. (c) Represents the difference between the recorded

debt (net of the discount or premium) and the consideration we paid

to retire the debt. (4) On October 1, 2009, we completed a consent

solicitation with regard to certain of our senior notes, and

entered into a new supplemental indenture (the Ninth Supplemental

Indenture) that amended certain indenture covenants, defined terms

and thresholds for certain events of default. We recognized $14.5

million in fees and expenses related to the consent solicitation

that are included in General and Administrative Expenses

("G&A") in our Consolidated Statements of Operations and FFO.

(5) In August 2009, we amended the Global Line, extending the

maturity to August 21, 2012 and reducing the size of our aggregate

commitments to $2.25 billion (subject to currency fluctuations)

after October 2010. The Global Line will continue to have lender

commitments of $3.7 billion (subject to currency fluctuations)

until October 2010, although our borrowing capacity may be less. In

August 2009, we issued $350 million of senior notes with a stated

interest rate of 7.625% and a maturity of August 2014. On October

30, 2009, we issued $600 million of senior notes with a stated

interest rate of 7.375% and a maturity of October 2019. We used the

proceeds from both issuances primarily to repay borrowings under

our Global Line and other debt. (6) On April 14, 2009, we completed

a public offering of 174.8 million common shares at a price of

$6.60 per share and received net proceeds of $1.1 billion that were

used to repay borrowings under our credit facilities. During the

third quarter of 2009, we issued 29.8 million shares and received

gross proceeds of $331.9 million and paid offering expenses of

approximately $6.9 million under our at the market share issuance

plan. (7) On January 1, 2009, we adopted the provisions of a new

accounting standard that requires noncontrolling interests

(previously referred to as minority interests) to be reported as a

component of equity and changes the accounting for transactions

with noncontrolling interest holders. (8) In our Consolidated

Statements of Operations, rental income includes the following (in

thousands): Three Months Ended Twelve Months Ended December 31,

December 31, ------------------- ------------------- 2009 2008 2009

2008 -------- -------- -------- -------- Rental income $169,188

$158,259 $658,462 $669,460 Rental expense recoveries 46,621 47,591

194,775 210,934 Straight-lined rents 11,553 9,346 37,858 33,256

-------- -------- -------- -------- $227,362 $215,196 $891,095

$913,650 ======== ======== ======== ======== (9) In response to

market conditions, during the fourth quarter of 2008 we modified

our business strategy. As a result, as of December 31, 2008, we

have two operating segments - Direct Owned and Investment

Management, and we no longer have a CDFS Business segment. We

presented the results of operations of our CDFS Business segment

separately in 2008. Our direct owned segment represents the direct,

long-term ownership of industrial properties. Our investment

strategy in this segment focuses primarily on the ownership and

leasing of industrial properties in key distribution markets. We

consider these properties to be our Core Portfolio. Also included

in this segment are operating properties we developed with the

intent to contribute the properties to an unconsolidated property

fund that we previously referred to as our "CDFS Pipeline" and,

beginning December 31, 2008, we now refer to as our Completed

Development Portfolio. Our intent is to hold the Core and

Development properties, however, we may contribute either Core or

Development properties to the property funds, to the extent there

is fund capacity, or sell them to third parties. When we contribute

or sell Development properties, we recognize FFO to the extent the

proceeds received exceed our original investment (i.e. prior to

depreciation). However, beginning January 1, 2009, we now present

the results as Net Gains on Dispositions, rather than as CDFS

Disposition Proceeds and Cost of CDFS Dispositions. In addition, we

have industrial properties that are currently under development

(also included in our Development Portfolio) and land available for

development that are part of this segment as well. The investment

management segment represents the investment management of

unconsolidated property funds and joint ventures and the properties

they own. (10) Beginning in 2009, we are reporting the direct costs

associated with our investment management segment for all periods

presented as a separate line item "Investment Management Expenses"

in our Consolidated Statements of Operations and FFO. These costs

include the property management expenses associated with the

property-level management of the properties owned by the property

funds and joint ventures (previously included in Rental Expenses)

and the investment management expenses associated with the asset

management of the property funds and joint ventures (previously

included in General and Administrative Expenses). In order to

allocate the property management expenses between the properties

owned by us and the properties owned by the property funds and

joint ventures, we use the square feet owned at the beginning of

the period by the respective portfolios. See note 2 related to the

Japan properties that we no longer manage. (11) As we announced in

the fourth quarter of 2008, in response to the difficult economic

climate, we initiated G&A reductions with a near- term target

of a 20 to 25% reduction in G&A prior to capitalization or

allocation. These initiatives include a Reduction in Workforce

("RIF") and reductions to other expenses through various cost

savings measures. Due to the changes in our business strategy in

the fourth quarter of 2008, we halted the majority of our new

development activities, which, along with lower gross G&A, has

resulted in lower capitalized G&A. Our G&A included in our

Statements of Operations consisted of the following (in thousands):

Three Months Ended Twelve Months Ended December 31, December 31,

------------------ ------------------- 2009 2008 2009 2008 -------

------- -------- -------- Gross G&A(a) $80,187 $89,299 $294,598

$400,648 Reclassed to discontinued operations, net of capitalized

amounts(b) - (8,906) (1,305) (21,721) Capitalized amounts and

amounts reported as rental and investment management expenses

(28,026) (43,406) (112,807) (201,577) ------- ------- --------

-------- Net G&A $52,161 $36,987 $180,486 $177,350 =======

======= ======== ======== (a) Included in G&A in the fourth

quarter of 2009 is $14.5 million of fees and expenses associated

with the consent solicitation discussed in Note 4. (b) G&A

costs included in discontinued operations is net of $2.3 million

and $11.3 million of capitalized costs for the three and twelve

months ended December 31, 2008, respectively. (12) During 2009 and

2008, we recorded impairment charges of certain of our real estate

properties and other assets as outlined below (in millions): Three

Months Ended Twelve Months Ended December 31, December 31,

----------------- ----------------- 2009 2008 2009 2008 ------

------ ------ ------ Included in "Impairment of Real Estate

Properties": Land held for development $135.8 $194.2 $137.0 $194.2

Completed and under development properties 3.5 34.8 126.2 34.8

Retail and mixed use properties 46.2 - 46.2 - Land subject to

ground leases and other 17.6 - 17.6 - Other real estate investments

4.6 45.7 4.6 45.7 ------ ------ ------ ------ Total impairment of

real estate properties $207.7 $274.7 $331.6 $274.7 Included in

"Impairment of Goodwill and Other Assets": Goodwill $ - $175.4 $ -

$175.4 Other assets 157.1 145.2 163.6 145.2 ------ ------ ------

------ Total impairment of goodwill and other assets $157.1 $320.6

$163.6 $320.6 ------ ------ ------ ------ Total direct owned

impairment charges included in continuing operations $364.8 $595.3

$495.2 $595.3 ====== ====== ====== ====== The impairment charges of

real estate properties that we recognized in 2008 and 2009 were

primarily based on valuations of real estate, which had declined

due to market conditions, that we no longer expected to hold for

long-term investment. Included in the 2009 impairment charges is

$9.2 million that should have been recorded in 2008. This amount,

along with an additional $3.0 million of deferred tax expense, was

recorded in 2009 and relates to a revision of our estimated

deferred income tax liabilities associated with our international

operations. In order to generate liquidity, we have contributed

certain completed properties to property funds (primarily in

Europe) and sold or intend to sell certain land parcels or

properties to third parties. To the extent these properties are

expected to be sold at a loss, we record an impairment charge when

the loss is known. The impairment charges related to goodwill that

we recognized in the fourth quarter of 2008 and related to other

assets that we recognized in 2009 and 2008 were similarly caused by

the decline in the real estate markets. (13) The following table

represents our share of income (loss) recognized by the property

funds related to derivative activity and the sale of real estate

properties (in thousands). Three Months Ended Twelve Months Ended

December 31, December 31, ------------------- ---------------------

2009 2008 2009 2008 ------- --------- --------- ---------- Included

in Earnings from Unconsolidated Property Funds in our Consolidated

Statements of Operations: Derivative gain (loss) $1,394 $ (19,189)

$ (6,306) $ (32,278) Gain (loss) from the sale of properties and

impairment charges, net $ 946 $(107,887) $ (4,831) $(106,420)

Included in FFO from Unconsolidated Property Funds in our

Consolidated Statements of FFO: Derivative loss $ - $ (1,182)

$(13,867) $ (9,274) Gain (loss) from the sale of properties and

impairment charges, net $ 683 $(108,218) $(12,720) $(106,914) In

the fourth quarter of 2008 we recognized a loss of $108.2 million

representing our share of the loss recognized by PEPR from the sale

of its 30% ownership interest in PEPF II. We acquired PEPR's 20%

interest in PEPF II in December 2008, and PEPR sold its remaining

ownership in PEPF II of approximately 10% to third parties in early

2009. (14) The following table presents the components of interest

expense as reflected in our Consolidated Statements of Operations

(in thousands): Three Months Ended Twelve Months Ended December 31,

December 31, ------------------- ------------------- 2009 2008 2009

2008 -------- -------- -------- -------- Gross interest expense

$101,314 $117,113 $382,899 $477,933 Amortization of discount, net

16,494 18,451 67,542 63,676 Amortization of deferred loan costs

5,877 3,474 17,069 12,238 -------- -------- -------- --------

Interest expense before capitalization 123,685 139,038 467,510

553,847 Capitalized amounts (16,199) (38,724) (94,205) (168,782)

-------- -------- -------- -------- Net interest expense $107,486

$100,314 $373,305 $385,065 ======== ======== ======== ========

Gross interest expense decreased in 2009 from 2008 due to

significantly lower debt levels, offset by increases in borrowing

rates. The decrease in capitalized amounts is due to less

development activity. (15) Included in Foreign Currency Exchange

Gains (Losses), Net, for the twelve months ended December 31, 2009

and 2008, are net foreign currency exchange gains and losses,

respectively, related to the remeasurement of inter-company loans

between the U.S. and our consolidated subsidiaries in Japan and

Europe due to the fluctuations in the exchange rates of U.S.

dollars to the yen, the euro and pound sterling during the

applicable periods. We do not include the gains and losses related

to inter-company loans in our calculation of FFO. (16) The

operations of the properties held for sale or disposed of to third

parties and the aggregate net gains recognized upon their

disposition are presented as discontinued operations in our

Consolidated Statements of Operations for all periods presented,

unless the property was developed under a pre-sale agreement. As

discussed in Note 2 above, all of the assets and liabilities

associated with our China operations were classified as Assets and

Liabilities Held for Sale in our accompanying Consolidated Balance

Sheet as of December 31, 2008, as well as one property in Japan

that we sold in April 2009. During 2009, other than our China

operations, we disposed of land subject to ground leases and 140

properties (aggregating 14.8 million square feet, 3 of which were

development properties) to third parties. This includes a portfolio

of 90 properties aggregating 9.6 million square feet that were sold

to a single venture during the third quarter in which we retained a

5% interest. We continue to manage these properties. During 2008,

we disposed of land subject to ground leases and 15 properties to

third parties, including 6 development properties. The income

(loss) attributable to these properties was as follows (in

thousands): Three Months Ended Twelve Months Ended December 31,

December 31, ------------------ ------------------- 2009 2008 2009

2008 ------ ------- ------- -------- Rental income $2,544 $34,582

$50,492 $121,685 Rental expenses (567) (13,422) (14,434) (42,058)

Depreciation and amortization (487) (9,012) (11,319) (33,661) Other

expenses, net - (16,603) (576) (34,917) ------ ------- -------

-------- Income (loss) attributable to disposed properties $1,490

$(4,455) $24,163 $ 11,049 ====== ======= ======= ======== For

purposes of our Consolidated Statements of FFO, we do not segregate

discontinued operations. In addition, we include the gains from

disposition of land parcels and Completed Development Properties

(2009) and CDFS properties (2008) in the calculation of FFO,

including those classified as discontinued operations. (17) In

connection with purchase accounting, we record all of the acquired

assets and liabilities at the estimated fair values at the date of

acquisition. For our taxable subsidiaries, we recognize the

deferred tax liabilities that represent the tax effect of the

difference between the tax basis carried over and the fair values

at the date of acquisition. As taxable income is generated in these

subsidiaries, we recognize a deferred tax benefit in earnings as a

result of the reversal of the deferred tax liability previously

recorded at the acquisition date and we record current income tax

expense representing the entire current income tax liability. In

our calculation of FFO, we only include the current income tax

expense to the extent the associated income is recognized for

financial reporting purposes. DATASOURCE: ProLogis CONTACT:

Investor Relations, Melissa Marsden, +1-303-567-5622, , or Media,

Krista Shepard, +1-303-567-5907, , both of ProLogis; or Financial

Media, Suzanne Dawson of Linden Alschuler & Kaplan, Inc,

+1-212-329-1420, , for ProLogis Web Site: http://www.prologis.com/

Copyright

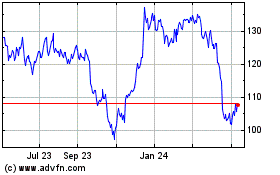

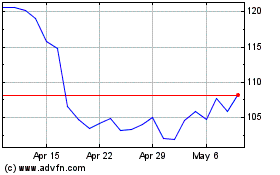

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2024 to May 2024

Prologis (NYSE:PLD)

Historical Stock Chart

From May 2023 to May 2024